SUMMARY

Amid buoyant markets, investors often disregard quality in equities. Recent uncertainty has changed that, as a new paper sets out.

Amid buoyant markets, investors often disregard quality in equities. Recent uncertainty has changed that, as a new paper sets out.

When you’re on the high seas and the waters turn choppy, it’s good to be aboard the sturdiest craft possible.

A similar principle applies in financial markets.

During times of volatility, it may well be safer to be invested in securities issued by the more robust companies.

The potential benefits of this approach – called “quality investing” – have been a key message of Citi Global Wealth Investments amid the heightened uncertainty of the past year and more.

But how to navigate this course in portfolios?

Among the possibilities are assembling a collection of quality shares or investing in a strategy that tracks a quality benchmark.

For suitable investors, though, there’s another potential course, as a new report from our hedge fund research team explores.

Before we dive into the report’s findings, though, let’s quickly establish what we mean by quality. While definitions across the industry can vary, a quality company is essentially one that has a robust balance sheet, stable earnings and high margins.

The report’s authors also explain quality in terms of strong businesses that have sustainable competitive advantages or operate in industries with considerable barriers to entry.

Over the long run, such companies’ shares have historically been more defensive in nature and have outperformed the wider stock market.

The S&P 500 Quality Index consists of higher quality US large-cap equities.

During the ten worst months for the broader S&P 500 Index, the quality index has fallen by less – figure 1.

By contrast, it underperformed during the S&P 500’s best ten months, rising by less.

| S&P 500 Quality Total Return Index (USD) | S&P 500 Quality – Lowest Quintile Index (USD, Total Return) | S&P 500 150/50 Quality Index (USD, Total Return) | S&P 500 Index (Total Return) | |

|---|---|---|---|---|

| Ten worst months for the S&P 500 Average Return |

-9.19% | -13.03% | -7.24% | -11.01% |

| Ten best months for the S&P 500 Average Return |

9.23% | 11.57% | 8.13% | 9.82% |

Given its characteristics and long-term performance, you might think quality would always be in demand.

However, that’s not really been the case in recent years.

In the 2017-2021 period, global equities overall performed strongly.

The MSCI World Index generated annualized returns of approximately 15%, with returns above 20% in three of five years.

Broad-based exposure to equities without a focus on quality worked nicely: the rising tide lifted all boats.

Lately, though, investors have begun to think rather differently.

Amid high inflation and market uncertainty, quality’s appeal has strengthened once more.

During tougher times, the highest quality equities have tended not only to outperform the wider stock market but also the lowest quality equities.

Certain hedge fund strategies seek to exploit this tendency.

They take long positions in higher quality equities and short positions in lower quality equities.

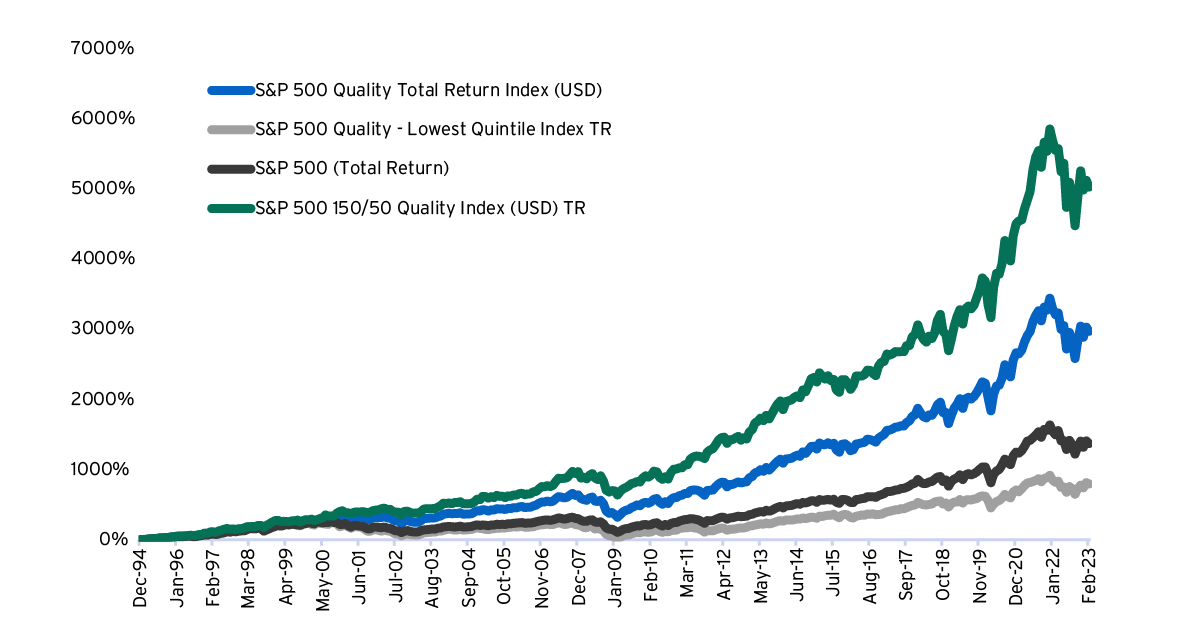

Figure 2 compares the total returns from exposure to four strategies since the end of 1994.

The best performing would have been a strategy of having a leveraged long position in the S&P 500 Quality Index while short selling the lowest quality stocks from the S&P 500.

Not only did this strategy produce the higher return, but it also produced a better return even after adjusting for the risks taken.

Despite the potential benefits of quality investing via a long-short hedge fund strategy, this approach is only for suitable for qualified investors due to the higher level of risk and portfolio leverage.

Hedge fund strategies come with various risks.

While the use of leverage can help to magnify returns, they can also enlarge losses if the markets move adversely.

In a worst-case scenario, the manager’s leveraged long positions could fall in value while the short positions could rise, exaggerating investors’ losses.

During phases such as early-stage market rebounds, low quality equities have often outperformed high quality equities.

Hedge funds strategies are often illiquid, in that investors typically can only exit during limited time windows every so often.

The uncertain conditions of recent times may have yet to pass.

We believe the economy in 2023 may be in a “rolling recession,” with different sectors suffering contractions at different times.

In this environment, we see an ongoing case for quality investing.

On a longer-term view, we also believe that long/short exposure to quality can potentially offer benefits to qualified investors’ portfolios, as in figure 2.

You can read more on this approach – and another quality strategy – in our new paper.

While our asset allocation strategy remains defensive, investors should consider staying invested and modify portfolios over time.

To help put you in touch with the right Private Bank team, please answer the following questions.