A highly concentrated US tech rally this year masks the value still present in global equities following the 2022 bear market. Economic and profits growth should bottom in the next few quarters, presenting an opportunity to diversify portfolios into non-US shares, profitable small firms, and still-depressed growth stocks.

A sequence of equity opportunities

Through May, global equities have already matched a typical year’s annual return, up 7% year-to-date. But under the hood, the rally has been far from broad-based.

Of the $4 trillion in global market cap created so far this year, 89% can be attributed to just 10 companies, mostly US mega-cap tech names (there are 2,880 companies in the MSCI AC World Index). While these market cap-weighted indices have delivered solid gains, the average return across S&P 500 constituents is closer to flat. US small caps have also missed out on the rally.

For many on the sidelines, the decision to buy equities or continue to sit in cash feels a lot harder. But the choice of whether to own the S&P 500 at 19x expected earnings or US T-bills at a 5% yield is an overly simplistic way of looking at the investment landscape. The global equity universe today presents us with plenty of compelling opportunities at reasonable valuations. Our Global Investment Committee recently added to shares in Asia, Europe, and Latin America which in aggregate trade at a 30% discount to the S&P 500. And given very top-heavy performance in the US, value is starting to emerge in profitable small- and mid-cap stocks as an additional alternative to expensive US large caps.

Will the next cycle be different for non-US stocks?

A common misconception among US-biased investors is that US stocks always have and always will trade at a premium to shares abroad. While this has certainly been true for the last decade or so, it is not a law of nature. In fact, for much of the last 100 years US equities have traded much closer to parity and sometimes even at a discount to their global peers (Figure 7: Emerging Markets Equities at Discount to US Equities in Currencies). Over the past 15 years, however, US equities have gradually richened relative to international shares as America’s tech dominance offered investors a highly coveted segment of growth in an otherwise muted global growth environment. While global equities are unlikely to simply surge higher in the year ahead, we see both cyclical and structural tailwinds for non-US shares in the expansion that will eventually follow the present period of economic uncertainty.

As we discussed in As US dollar dominance ends, currencies may drive returns, an eventual unwind of aggressive Fed tightening should take some steam out of the US dollar’s rally vs major currencies. As US interest rates fall, investors who flocked to higher-yielding US assets and high-quality US equities may need to look elsewhere in the world to find better value.

Meanwhile, meaningful corporate governance reforms in Japan and Europe also look promising. Japanese financial authorities are actively incentivizing companies to return more cash to shareholders, catching the attention of some of the world’s largest investors. In Europe, conglomerates have been spinning off businesses at a premium while simplifying their structures. Buybacks and M&A have also picked up this year.

Lastly, long-term thematic trends can also explain US equity market dominance over the past decade. Growth in the major trends of the 2010s like social media, e-commerce, cloud computing, and smart phones were all dominated by US tech giants. But in the next decade, unstopable trends like global aging, electrification & decarbonization, and a rising Asian middle class may benefit more than just US firms. Pharmaceuticals, brands servicing emerging markets consumers, and clean energy leaders can be found across the global equity landscape. Investing with a US bias risks missing out on a key subset of these potential winners.

Capturing improving value outside of mega-caps

Aggressive monetary and fiscal stimulus during the pandemic was aimed at supporting businesses facing existential risks from the stay-at-home economy. This support helped smaller, riskier firms outperform the giants in the year following the 2020 COVID lows. But the side effects of that stimulus – surging inflation and sharply rising borrowing costs – have benefited large firms with scale and pricing power. Meanwhile smaller firms have lagged, giving up all of their post-COVID era gains.

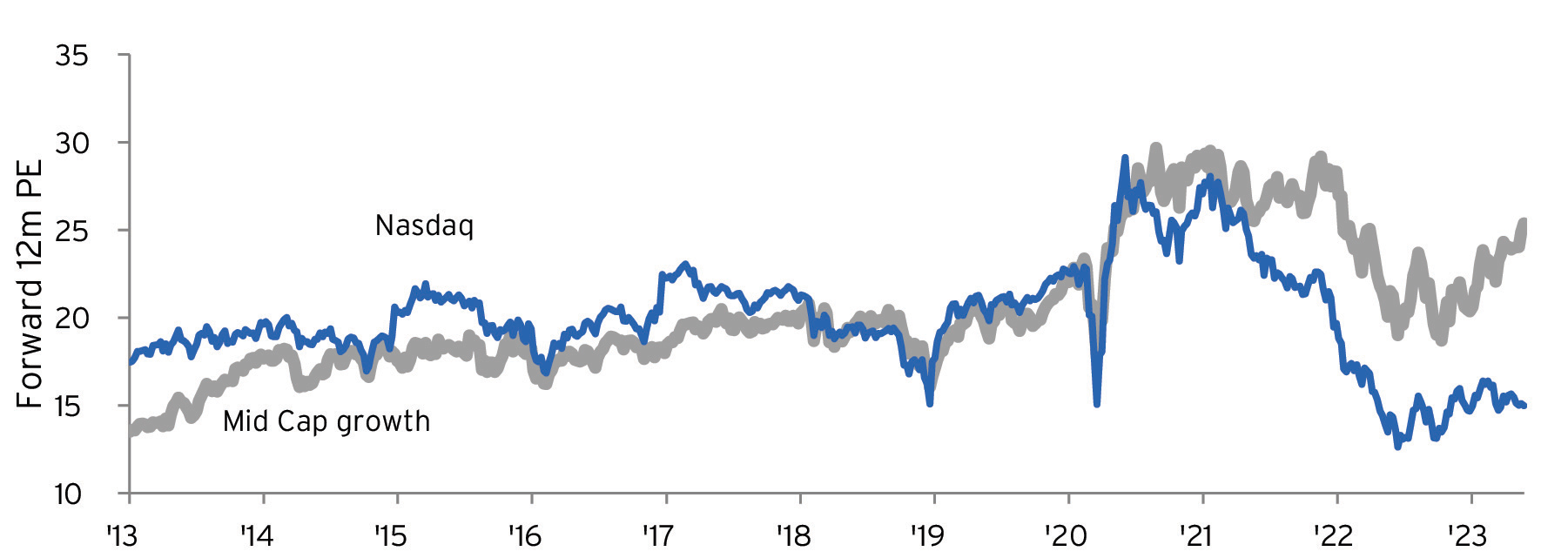

Small- and mid-cap stocks’ (SMID) tepid performance over the past two years means that valuations have improved, with profitable small cap names now trading at a 26% discount to larger peers. While large cap growth in particular has rallied in 2023, fast-growing small firms remain in the doldrums (Figure 1). Market expectations for a Fed pivot should change this paradigm, enabling a catch-up in small-cap growth shares, led by non-cyclical health care and technology firms.

Small-cap value benchmarks are closely tied to performance of regional banks. It is hard to be sure the cascade of small bank failures is behind us, while further consolidation is likely, but broad regional bank shares should recover once economic conditions stabilize. Regional banks play a key role in the US economy, facilitating and underwriting loans to small businesses in local markets where large banks are not players. From a valuation perspective, regional banks have only been cheaper on a price to tangible book basis during the depths of COVID and during the Great Financial Crisis. While it may be premature to add in a tactical window, quality small cap value shares look compelling at current levels with a multi-year time horizon.

With capital costs still high, stick to profitable small caps

While the value proposition in small-cap shares is apparent, moving down in cap does not come without taking on some additional risk. When the Global Investment Committee moved SMID to overweight in April 2020, economic and pandemic-related conditions were still highly uncertain but policy was unambiguously supportive. Investors unfortunately don’t enjoy those same tailwinds today, with the Federal Reserve still yet to signal a shift towards easing and US fiscal deficits more likely to contract than expand in coming years. The longer interest rates stay high, the greater refinancing risk will be for small, more highly levered companies.

Given this uncertainty on the interest rate front, our preferred way to play the SMID space is through an up-in-quality approach. Profitable small firms are more likely to survive a period where capital costs remain elevated than those that rely on access to debt or equity markets to sustain growth. This is a segment of the equity market where active management can add real value by hunting for under-the-radar opportunities while avoiding value traps at risk of stagnation or bankruptcy.

What to do with expensive defensives

Hiding out in value and defensive sectors was a winning playbook in 2022. Dividend growth shares outperformed the broad market by 12%, while sectors like energy, pharmaceuticals, staples and utilities delivered positive performance as growth shares plunged. This ongoing macro uncertainty has led many investors – including us – to hoard stability in portfolios.

As economic and profits growth bottoms in the next few quarters, this year may mark the twilight of the defensive trade. The Global Investment Committee already trimmed our overweight to global pharmaceuticals after 23% outperformance vs global equities since mid-2021. US large cap value shares are now trading at valuations 21% above their average since 1995. But not all defensives were spared last year. Faster-growing health care segments like biotech and life sciences were hit by rising capital costs, but their underlying business models should be relatively uncorrelated to the economic cycle.

The earnings of cyber security specialists remain resilient and will likely be a key secondary beneficiary from the buildout of AI, as discussed in Generative AI: The beginning of (another) technological revolution, Global dividend growth is another tactical overweight that has seen smaller drawdowns since the bear market began in 2022. While dividend growers tend to lag in early cycle recoveries, this strategy should have a permanent place in core portfolios given its track record of long-term outperformance.

To help put you in touch with the right Private Bank team, please answer the following questions.